How to Lead a Financial Transformation Initiative

The best organizations approach financial transformation as if finance were a profit center. The old way of looking at financial operations was as a cost-center. If you agree, then that mindset changes everything about your financial transformation.

That insight could change the company's business model and the operating model.

It will be how the board and leadership team gain the alignment on performance metrics and the way that you, as a Financial Transformation leader, create value. It even changes the way that you refer to the stakeholders who benefit from finance, as they become more than "users", but instead "customers" and "advocates" for your Financial Transformation.

Download our e-Book

In submitting this form, you agree to receive information from Lima Consulting Group about our products, events, and special offers. You can unsubscribe from such messages at any time. We never sell your data, and we value your privacy choices. Please see our Privacy Policy for information.

This e-book is written for:

Those who are charged to lead financial transformation initiatives

Click the link to go to a specific section:

For those organizations that reach the final stages of maturity in their transformations, they disrupt incumbents, revolutionize industries, and innovate society.

Ultimately, they provide value and in many cases, they take a winning position to rewrite the rules of value creation for their constituents and customers.

If you're a newly appointed financial transformation leader, or if you've been through a number of financial transformations, this document is for you.

So you've been "volun-told" to step into this exciting, newly-created position at your organization. Whether this investment is in reaction to a competitive imperative, or an ambition to lead your industry with competitive differentiators, senior financial leaders in the non-profit industry can use this guide to help strategically plan and execute a comprehensive roadmap for financial transformation.

To be transformative, your initiative will go beyond aligning the finance department as a part of your company's General and Administration expenses and instead focus on increasing revenue, decreasing costs and mitigating risks.

It will be multi-disciplinary, and inter-departmental, and may require some skills that the organization doesn't have today. Some staff will need to be trained, others up-skilled, and you may need to hire or outsource to add additional skills to your team. You may even need to establish new partnerships.

Using a comprehensive approach, financial transformation will enable your staff to leverage computing power and capture the value in your data. It will avail your organization to new business models, and provide the fundamental building blocks to empower the organization to adopt a data-driven operating model.

Lima Consulting Group defines a "hybrid organization" as one that combines the best of both human and machine capabilities to achieve superior performance and competitive, sustainable advantage.

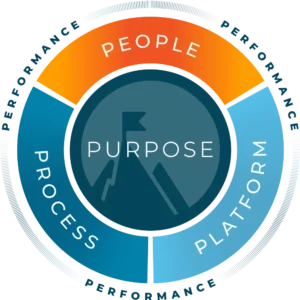

Organizations that want to reach a hybrid state - leveraging the power of data while augmenting human power - need to bring together Purpose, People, Process, Platforms and Performance.

By embracing these characteristics, a hybrid organization can achieve significant benefits, including increased productivity, higher quality, faster innovation, and better customer satisfaction. Those who do create sustainable, competitive advantages.

What will you learn?

In this document, you will learn a comprehensive approach for your financial transformation across the 5 dimensions below:

Purpose

Aligning your business model to your key processes; both value driving and cost-driving processes. As your organization explores the role of finance, your initiative will be positioned to create the business case to seek the funding in line with its value rather than by merely estimating a percentage of revenue or benchmark, which may have little merit relative to the value creation at stake.

Process

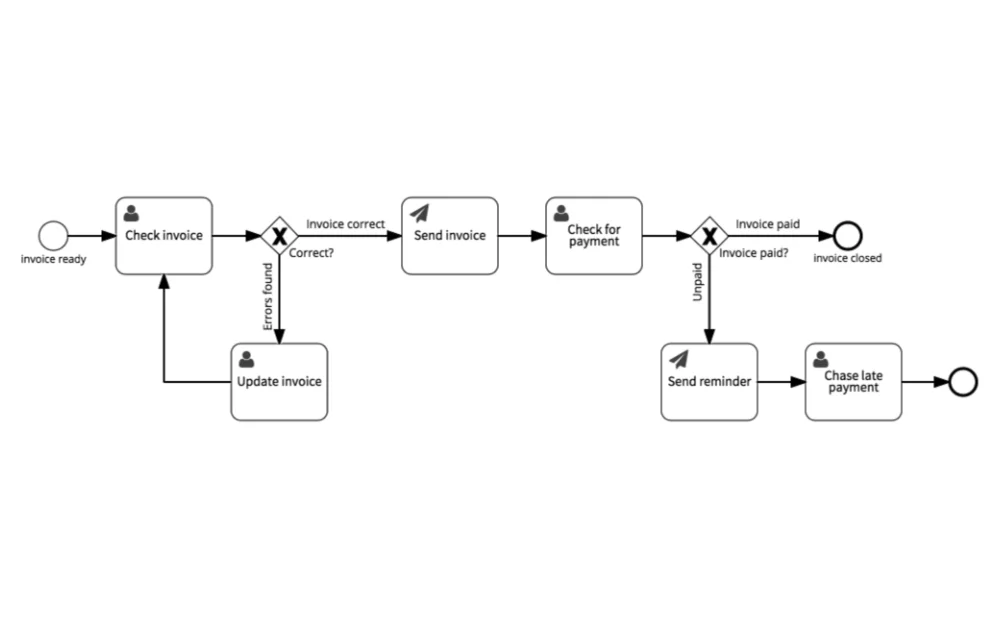

You cannot digitize what you have not documented. The promise of automation implies that there is a consensus view within the organization of what "good" looks like. Good processes, good numbers, and good results don't just happen, they are engineered and supported by technology. Hybrid organizations are process dependent, not person dependent. But getting there requires that at least 35% of your value driving and cost driving processes are leveraging the power of automation.

People

Change is hard. It's multi-disciplinary. It's inter-departmental. And it's a team sport. Conducting a skills gap assessment and adopting the right mix of in-source, out-sourced and partners will be critical in the first stages of your initiative.

Platforms

Technology should support the desired business outcomes. Discussions about selecting the right ERP solution should come after your Assessments on your People, and your Inventory of your Processes. Only then are you in a position to set your Build to be on-time and on-budget.

Performance

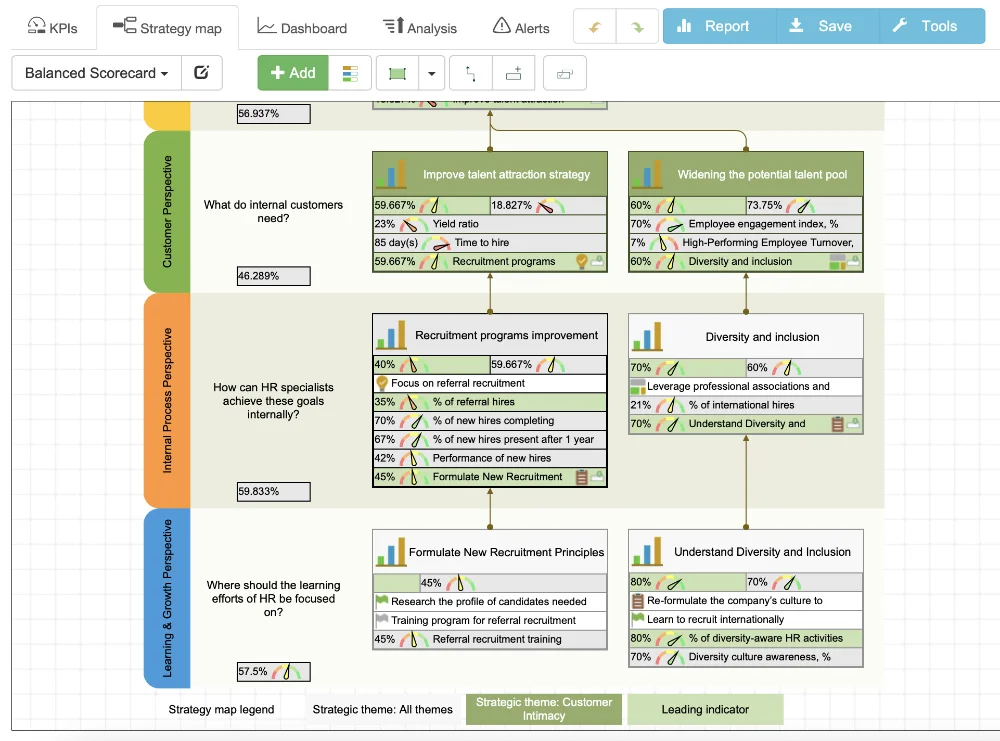

Align your key business objectives with a key performance indicators by using a balanced scorecard. Leverage best practices from design thinking to help elevate all your subject matter expert's communications to a multidisciplinary language. If you do, you'll also put your organization in a posture to begin applying agile methodologies so that you don't need to wait for a big bang and can start capturing value along the way.

Introduction

The Lima Consulting Group has been a part of over 100 digital transformations as Trusted Advisors. We often get the call asking our practice leaders, "How do I start my Financial Transformation?" Sometimes, the change agents from within who are looking to build the business case by finding incremental paths in order to gain consensus. In other cases, they have been directed by a Board who is "all-in" to build a comprehensive roadmap and budget to deliver transformative change.

In both cases, this guide will provide you, the Financial Transformation leader, with the tools and rubrics you need to be able to break the inertia, gain the consensus, right-size your span of control and effectively demonstrate that Financial Transformation is underway under your leadership.

This is, by no means, a comprehensive guidebook. Instead, we offer this as a guide to keep newly appointed Financial Transformation leaders from falling into common pitfalls and help you explode off the blocks. Your board and leadership are expecting you to quickly establish the momentum needed to show that Financial Transformation is underway within your organization. Here's how.

The Challenges

Purpose Challenges:

- Gaining alignment on who the customer is

- Adopting transformative business models

People Challenges:

- Breaking silos

- Consensus and finding sources of funding

- Thinking big

- Attitude towards failure

Process Challenges:

- Documenting then digitalizing

- Prioritizing digital investments

Platform Challenges:

- Selecting the right technology

- Upskilling the workforce

- Integrating systems

Performance Challenges:

- Alignment of KBOs with KPIs

- Cultural shift to a data-driven operating model

Top Challenges Executives Face with Financial Transformation

Source: https://blog.workday.com/en-us/2022/global-study-finance-leaders-tech-leaders-now.html

Guiding Principles

Start with the customer

Lead with Strategy

Adopt a process orientation over people dependency

Treat your data as if it were money

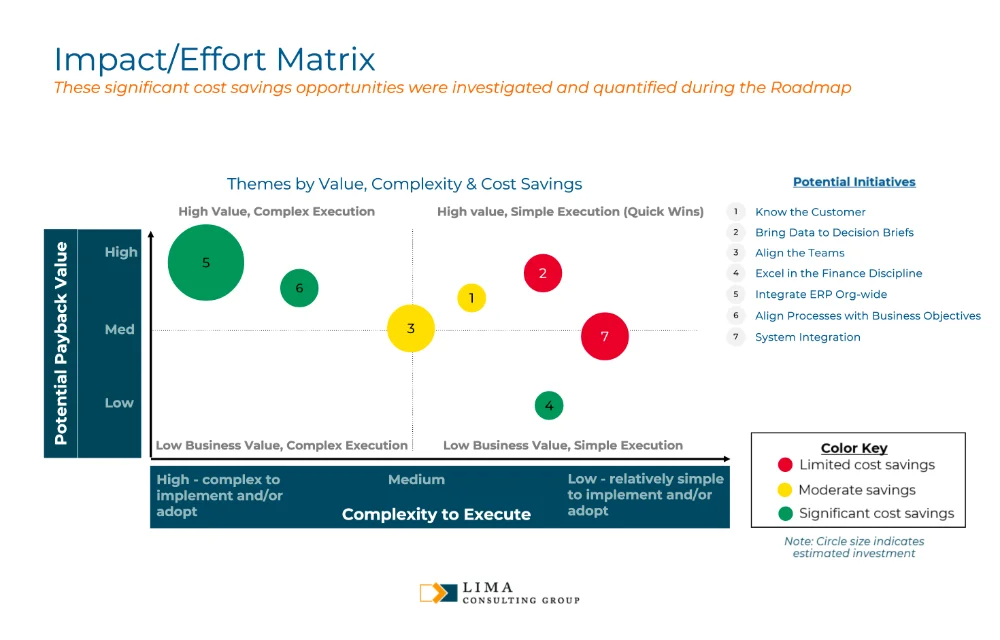

Balance quick wins using an impact/effort matrix

Overcommunicate

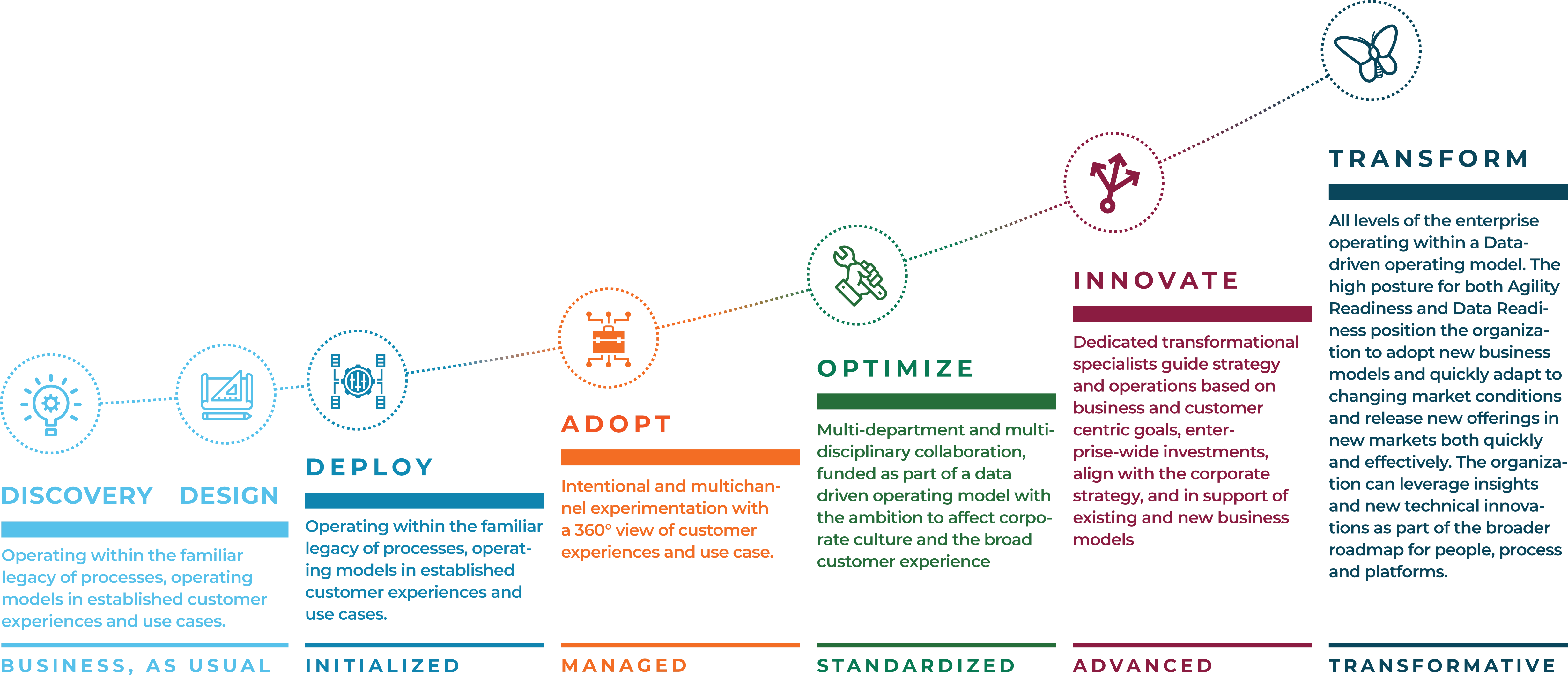

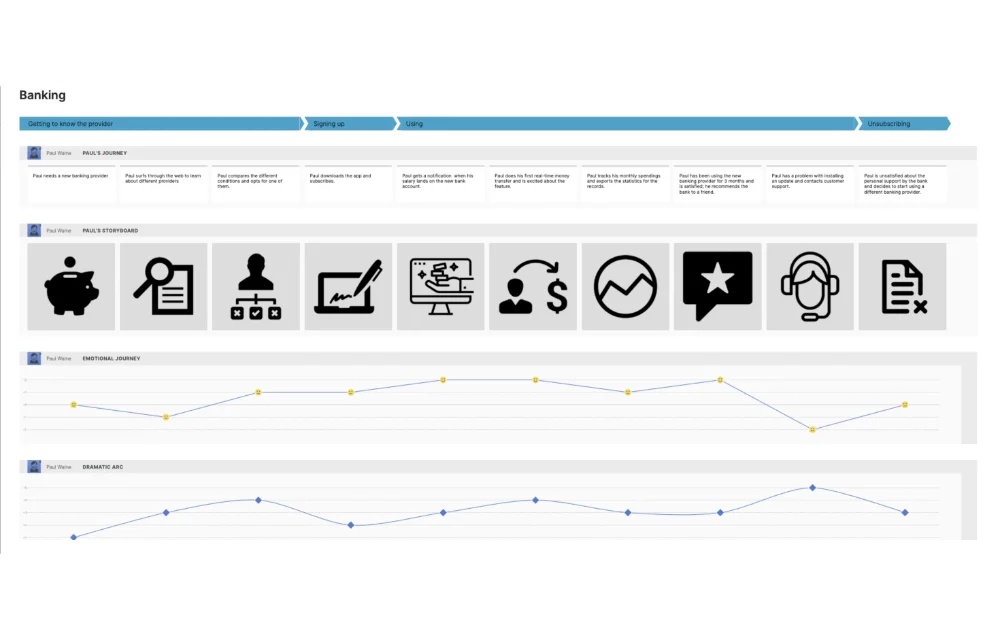

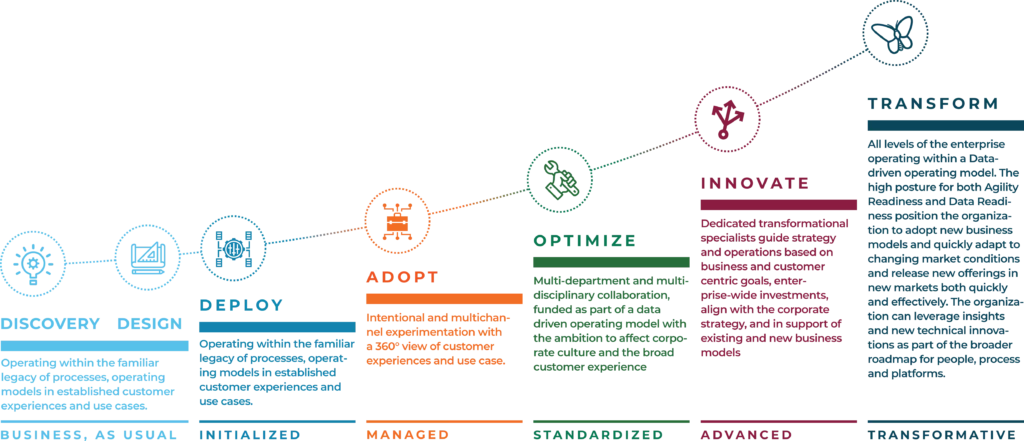

In treating Financial Transformation as a profit center, the inherent assumption is that you’re better serving customers and delivering value. As such, it’s important to identify who your customers are early in your transformation. As you begin that exploration, the language you use in assessing your maturity will take on a customer-centric view Financial Transformation Maturity.

Business, as Usual

- Building use cases and the business case.

- Conducting Assessments of Skill Gaps, Process Inventory and Process Documentation.

- Assessing the alignment of financial capabilities with the Balanced Scorecard and desired business outcomes.

Initialized

-

Looking for quick wins and building small use cases that can be leveraged with discretionary budgets.

-

Building the business case to take to the Executive Committee and board to fund a proper Financial Transformation.

-

Balancing an impact effort matrix to identify a portfolio mix of initiatives – some that are quick hits, others that provide long-lasting, sustainable, competitive advantages.

-

Recruiting specialists and investing in specific training for specific experts.

Managed

-

Assembling multidisciplinary teams to assess their value-driving and cost-driving processes.

-

Documenting the processes as constituted today, as well as re-imagining the processes so that they can be effectively executed within the technology platform of choice.

-

Challenging their teams to identify workflows, and even assess a band of excellence to identify Straight Through Processes.

-

Similarly documenting Exceptions Based Processes and, where feasible, carefully re-engineering them so that they can be promoted to STPs, improved, or eliminated.

-

Enabling subject matter experts with training and access to resources to implement and adopt changes to processes.

Standardized

-

Ensuring processes are engineered and fully deployed within the Platforms across the enterprise.

-

Ensuring processes can be simulated and improvements can be quantified using process intelligence and simulation techniques.

-

Ensuring processes can be automated to a great degree, using tools like robotic process, automation, artificial intelligence, machine learning, and process intelligence.

-

Enabling users of the solution with training and access to resources to implement and adopt the changes to processes.

Advanced

-

Identifying processes that can be fully automated.

-

Optimizing deployments of the processes and platforms.

-

Ensuring a high degree of creativity to assess new business models and conduct scenario planning to launch additional offerings, eliminate offerings, and open new markets.

-

Enabling mid-level and senior leadership with training and frequent vision formulation workshops to assess the impact of FX and prioritize future investment.

Transformative

-

Changing their industry

-

Launching new products

-

Entering new markets

-

Challenging established norms

-

Innovating

-

Adding value in ways that have never been done before

-

Enabling the industry with thought-leadership and results oriented use cases to establish their leadership position.

Guiding Principles

Start with the customer

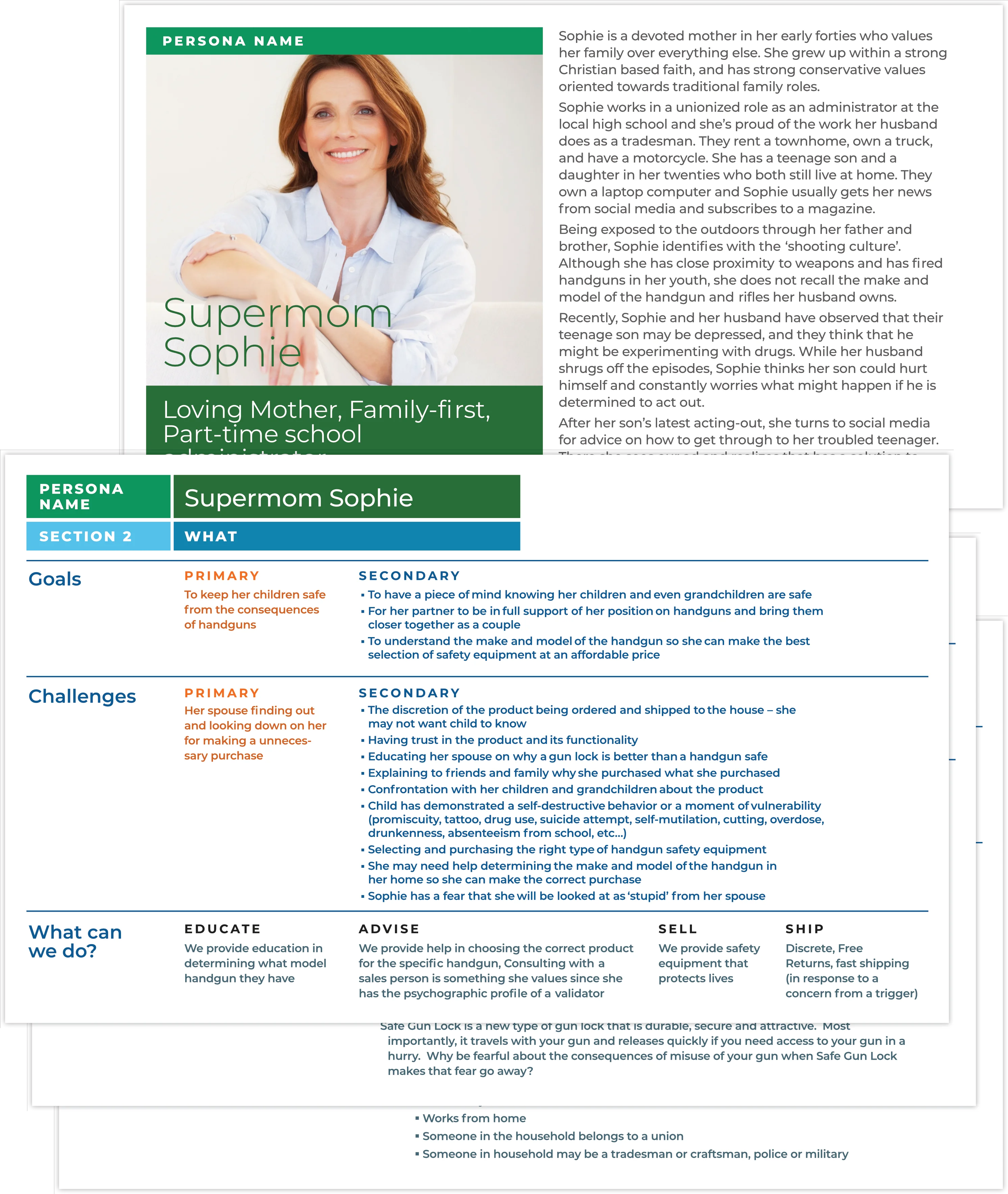

In many non-profits, it's not clear who the customer is. There are many. You can't serve everyone. Early on gain alignment on who your primary stakeholders are or, if appropriate, who your Financial Transformation Customers will be.

Individual funders, institutional funders, partners, employees, volunteers, government entities, regulators, and of course, those who are ultimately served by the charitable mission. In non-profits, where the buyer is not the payer, it's important to break down the pain of each and understand their needs.

Lead with Strategy

Assess the current business model and conduct scenario planning to assess future business models that align with the Purpose of your non-profit.

Align budgets and priorities based on this unique corporate strategy. Then build the business case and conduct design thinking to gain the consensus and break the inertia so that your organization is prepared to innovate. New capabilities will require that your organization consider new business models and new operating models.

Adopt a process orientation over people dependency

Companies don't make money, people do. While many organizations have some workers who view themselves as indispensable fountains of knowledge, senior executives know that great organizations are process-dependent. Knowledge workers who are slow to reveal their processes generally don't know how, or don't have a process.

Treat your data as if it were money

When a customer gives you money, do you put it in a drawer and forget about it? No, you have corporate standards and Generally Accepted Accounting Principles that require that organizations centralize financial assets, and that they report with transparency and routinely. And so it should be with data. Your data should be centralized, governed by a data steering committee, and accessible in near real time.

Balance quick wins using an impact/effort matrix

Balance the desire to show "quick-wins" with the priorities that can create sustainable, competitive advantage. Quick-wins are typically great for winning the budgets to initiate Financial Transformation, but often work at cross-purposes towards meaningful innovation and lasting business impact.

Overcommunicate

Take a storytelling approach to Financial Transformation. It's memorable and will accelerate the adoption across your stakeholders. Leverage other endo-marketing efforts, internal newsletters, kiosks at the cafeteria, webinars, and other internal communications to stay in front of the rank and file and ensure that your initiative owns its own messaging.

5 Pillars of Financial Transformation

Purpose - Embracing Business Model Innovation

Non profits inspire our world. As mission driven organizations, their purpose is internalized by their staff.

Yet every board meeting a portion of the agenda can be summarized by the phrase: "No margin, no mission". Being a non-profit is only a tax and legal entity status, it isn't a business model.

While the business model focuses on the overall strategy and revenue generation, the operating model deals with the day-to-day operations and processes required to execute that strategy.

Business Model Definition:

A business model is a high-level plan for how a company intends to generate revenue and make a profit. It includes the core strategy of the business, its target customers, value proposition, revenue streams, cost structure, and key partners and resources required to deliver on the strategy.

Operating Model Definition:

On the other hand, an operating model defines how a company will execute its business model by specifying the processes, policies, procedures, and systems required to operate the business efficiently and effectively. It includes aspects such as organizational structure, roles and responsibilities, workflows, technology systems, performance metrics, and governance.

Balanced Scorecard Definition:

The balanced scorecard is a management tool that helps organizations align their strategies with their goals and objectives. It provides a framework for measuring and monitoring performance across four different perspectives, which are financial, customer, internal business processes, and learning and growth.

Financial Perspective: In the context of a financial transformation initiative, the financial perspective is a logical place to start. It focuses on financial performance and helps organizations assess the financial impact of their initiatives. The financial perspective of the balanced scorecard measures the financial results of the transformation initiative, including revenue growth, cost savings, profitability, return on investment, the value of risks that are able to be mitigated, and cash flow. This perspective provides a way to track progress and determine whether the initiative is delivering the expected financial benefits and agility to the organization.

Customer Perspective: This perspective focuses on the needs and expectations of the customers. It helps organizations understand the customer experience and identify opportunities to improve customer satisfaction, retention, and loyalty.

What actions does the customer need to take in order for the organization to realize their financial goals? Typically customers need to purchase something. However, with non- profits, this particular aspect or perspective of the balance scorecard can be complicated since the buyers are not typically the payers.

For a financial transformation initiative, this perspective is important because it helps organizations ensure that their initiatives are aligned with customer needs and expectations.

Internal Business Processes Perspective: This perspective focuses on the processes and systems that are necessary to deliver products and services to customers. It helps organizations identify opportunities to improve efficiency, quality, and productivity. For a financial transformation initiative, this perspective is important because it helps organizations streamline their financial processes, reduce costs, assess and mitigate risk, and improve financial performance.

Learning and Growth Perspective: This perspective focuses on the people and systems that are necessary to support the organization's goals and objectives. It helps organizations identify opportunities to improve employee skills and capabilities, and to invest in technology, partnerships, and infrastructure. For a financial transformation initiative, this perspective is important because it helps organizations ensure that they have the necessary resources and capabilities to implement the initiative successfully.

In our experience the balanced scorecard is one of the most effective tools that a management team can use in order to gain alignment before investing in a financial transformation. It is also very powerful tool to communicate to a board. Many boards have strategic planning committees and are also involved in building the balanced scorecard given that it is an effective governance tool.

People - Multidisciplinary and Interdepartmental teams

Change is hard. It’s multi-disciplinary. It’s inter-departmental. And it's a team sport.

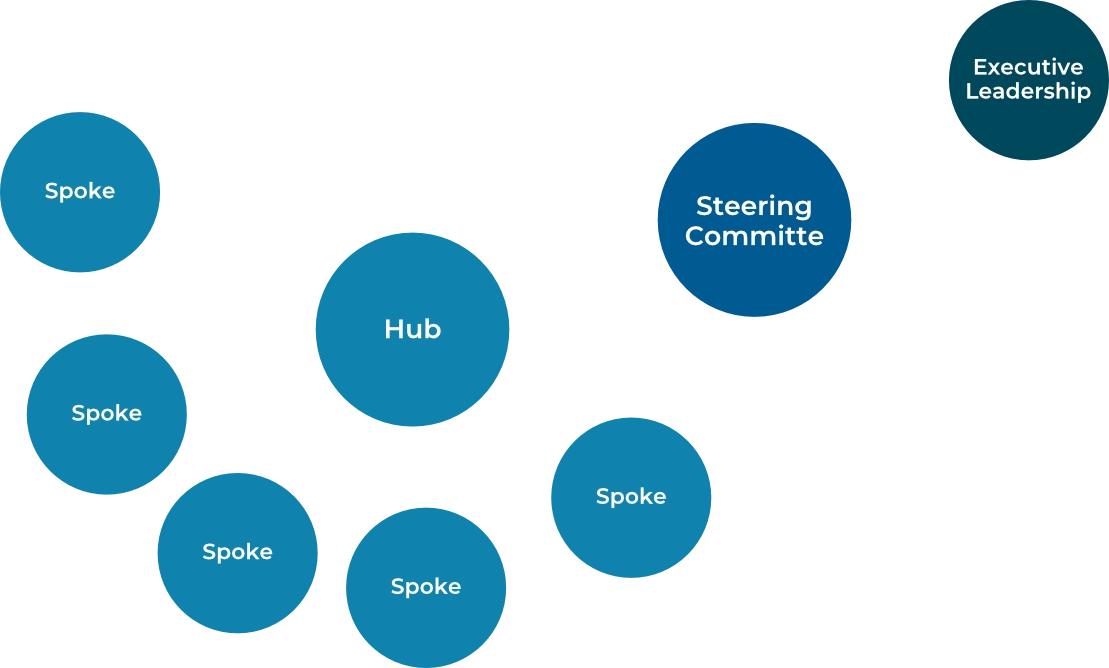

Select the organizational design:

Decentralized:

Decisions made by mid and lower-level managers across their respective area with extensive delegation throughout.

Centralized:

Decisions made from the top. Roles and capabilities are centralized into a single area or team.

Honeycomb:

Anyone in the organization can create content in accordance with SOPs.

CoE:

Center of Expertise. Decisions made together. Centralizes specialized skills and functions under a cohesive strategy (vision & SMEs), while allowing execution to thrive in respective areas with flexibility.

Dandelion:

Hub & Spoke teams within companies act autonomously under a common brand. Commonly used in Multi-Nationals with established digital hub & spoke teams and evolves into the Multiple H&S model (Dandelion).

If your organization chooses a CoE design, here is what governance & controls might look like:

Executive Leadership

Define and prioritize Key Business Objectives (KBO)

Steering Committee Responsibilities

- Develop strategic roadmap with input from BUs

- Define KPIs and metrics across the business

- Review performance of BU programs and evaluate application to the rest of the business

- Drive architecture roadmap capabilities

CoE (Hub) Responsibilities

- Lead digital strategy development with BUs

- Evaluate and validate business unit projects

- Develop, publish and enforce best practice

- Provide support and subject matter expertise

- Train and enable BUs to execute

BU (Spoke) Responsibilities

- Apply localized versions of digital strategy

- Execute digital initiatives with support of COE

- Analyze and report findings back to the COE

Skills Gap Assessment:

Consider conducting a skills inventory to help you understand what skills you need, when you will need them, and if you have the people in-house to staff the initiative. You may be able to accelerate the planning and execution by outsourcing key functions and roles while you stand up the competency within.

3-5 year people plan:

A 3-5 year plan presumes that you have an organizational construct that you will be leveraging, such as the hub & spoke model. See the above example of an organizational chart where each future role has been designated a hiring priority - A, B, or C. 'A' means hire now, 'B' means hire in the next 18 months, and 'C' means hire 3 years down the road. This chart is a work product that LCG built for a real client. Our team of experts can make suggestions around the functional areas and reporting hierarchy your organization will need to initiate and sustain financial transformation. Job categories & descriptions should fit your organizations digital future.

Process - Augmenting People through Automation and Data

The promise of automation implies that there is a consensus view within the organization of what “good” looks like. Good processes, good numbers, and good results don’t just happen, they are engineered and supported by technology. Hybrid organizations are process dependent, not person dependent.

To learn more about documenting business processes using Signavio.

Platforms - Support desired business outcomes

Technology should support the desired business outcomes.

Discussions about selecting the right ERP solution should come after your Assessments on your People and your Inventory of your Processes. Only then are you in a position to set your Build to be on-time and on-budget.

Tech Stack:

The set of digital tools used by an organization to transform its financial operations. The tech stack typically includes a combination of software for financial planning and analysis, accounting, reporting, and compliance.

Examples of technologies commonly used in a financial transformation tech stack include:

- Enterprise resource planning (ERP) software for managing financial data and transactions across different departments and functions.

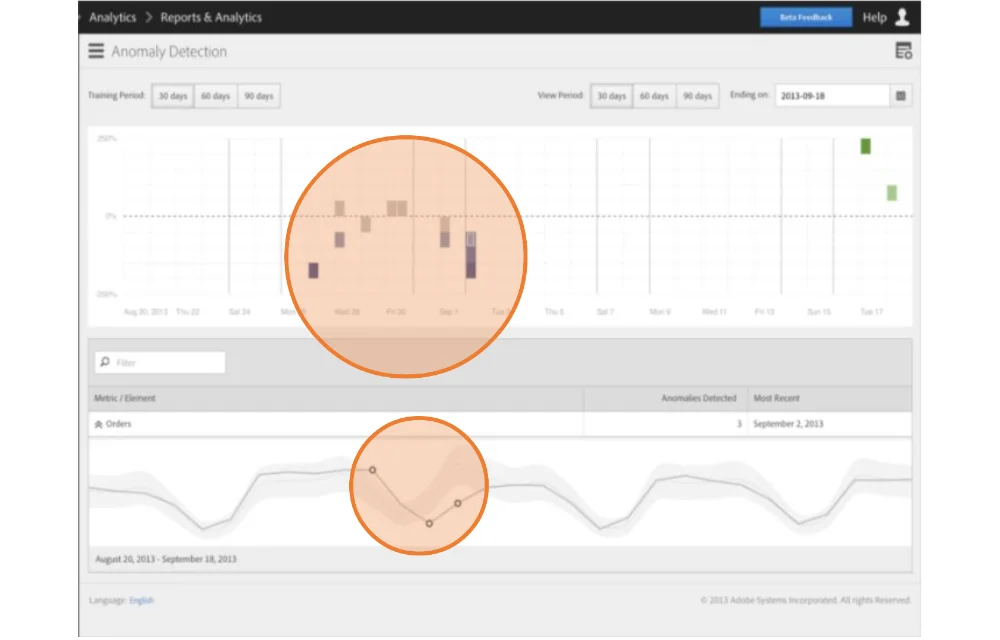

- Business intelligence (BI) and data analytics tools for gaining insights into financial performance and identifying trends and opportunities.

- Robotic process automation (RPA) and artificial intelligence (AI) for automating repetitive financial processes, such as accounts payable and accounts receivable.

- Cloud-based accounting software for managing accounts, budgets, and financial reporting.

- Regulatory compliance software for ensuring compliance with financial regulations and standards.

Overall, the tech stack in financial transformation plays a critical role in helping organizations to become more efficient, agile, and data-driven in their financial operations.

Architecture:

Identify the desired architecture and understand the data you have available to you: where will the data move to and from? Map out the ways that data will be used and how it will be transported (which is different than where it is stored) in support of the desired customer journey. Identify the systems of record, the data of record, when data will be at rest, when it will be in motion, the intervals of motion, and any risks associated with the motions. Identify what iPaaS (Platform as a Service such as Mulesoft, Boomi, etc…) systems you may need, if there are any DMZs (demilitarized zones), how the data will flow within the organization, and if you can pass data externally to 2nd party data providers, partners, or agencies performing services on your behalf. Don't forget about single sign on (SSO) because some of these data flows rely on authenticating users who are external parties. You may need to provision active directory access or create new certificates and API tokens for 3rd parties, a process that might take a long time if your IT team has not done it before. Lastly, identify any need for legal resources to help with data sharing agreements and compliance with GDPR or similar local requirements.

Data Governance:

Data governance should be clearly defined and allow for input from anywhere within the organization. For example, a data-cleansing algorithm might be optimal for one business unit, but sub-optimal for another business unit. Who decides if the entire database will be subject to the new data cleansing model? In organizations where BUs compete, how should these decisions be made? Start with understanding what skills are going to be needed and build process maps for how decisions will be made before the initiatives begin. Who will arbitrate if there are conflicts? Will you defer to a 3rd party Trusted Advisor, a C Level executive, or a majority vote among equals within the Data Governance Steering Committee?

Build the Steering Committee with a multi-disciplinary and inter-departmental construct in mind. While the initiatives might originate and be funded by whomever is out in front, financial transformation is an enterprise-wide initiative. The investments made and data readiness decisions will affect those business units that start their journeys later on.

Documentation:

While the Agile methodology does change the way organizations may document technical requirements, it does not alleviate the need to document. Typical technical documentation usually includes User Acceptance Testing (UAT), Systems Integration Testing (SIT), Customer Acceptance Testing (CAT), technology design, data flows, and data change management requirements.

Performance - Adopting a Data-Driven Operating Model

Align your key business objectives with a key performance indicators by using a balanced scorecard.

Key Business Outcomes:

Using the digital balanced scorecard, identify the operational objectives needed to support the desired business outcome. Categorize all processes to those that drive value or cost. Value-driving processes generally relate to the cost of goods sold. They're typically part of the product or service delivery and are why the customer buys from you. They are competitive differentiators and support your Unique Value Proposition. These processes are the secret sauce and are usually highly guarded. They are the sustainable advantages that companies invest in as a part of their differentiation in their GoToMarket (GTM) strategy.

Key Performance Indicators:

Once you've aligned the desired outcomes and Key Business Objectives, you're ready to determine the performance metrics. A mistake executives often make is that they view the KPI as a single goal to be evaluated annually. We completely agree with this, but it is so much more than just that. It's important to time-part the goal and understand the critical moments through the day, week, month or relevant digital time period.

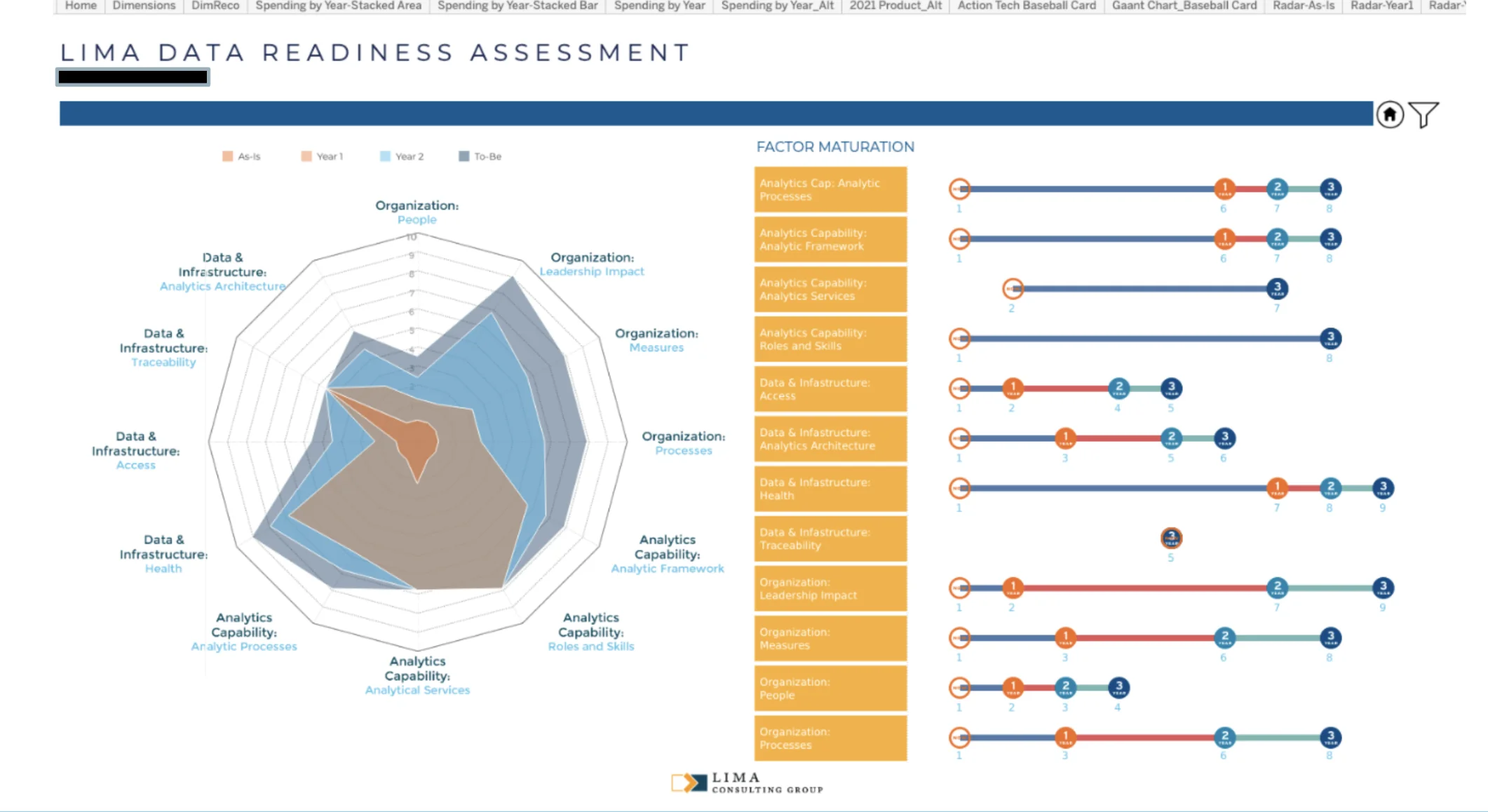

Data Readiness Assessment:

An evaluation of an organization's ability to collect, manage, and use data effectively. It involves a comprehensive analysis of the data sources, systems, processes, and people within the organization to determine their readiness to leverage data for strategic decision-making and business operations.

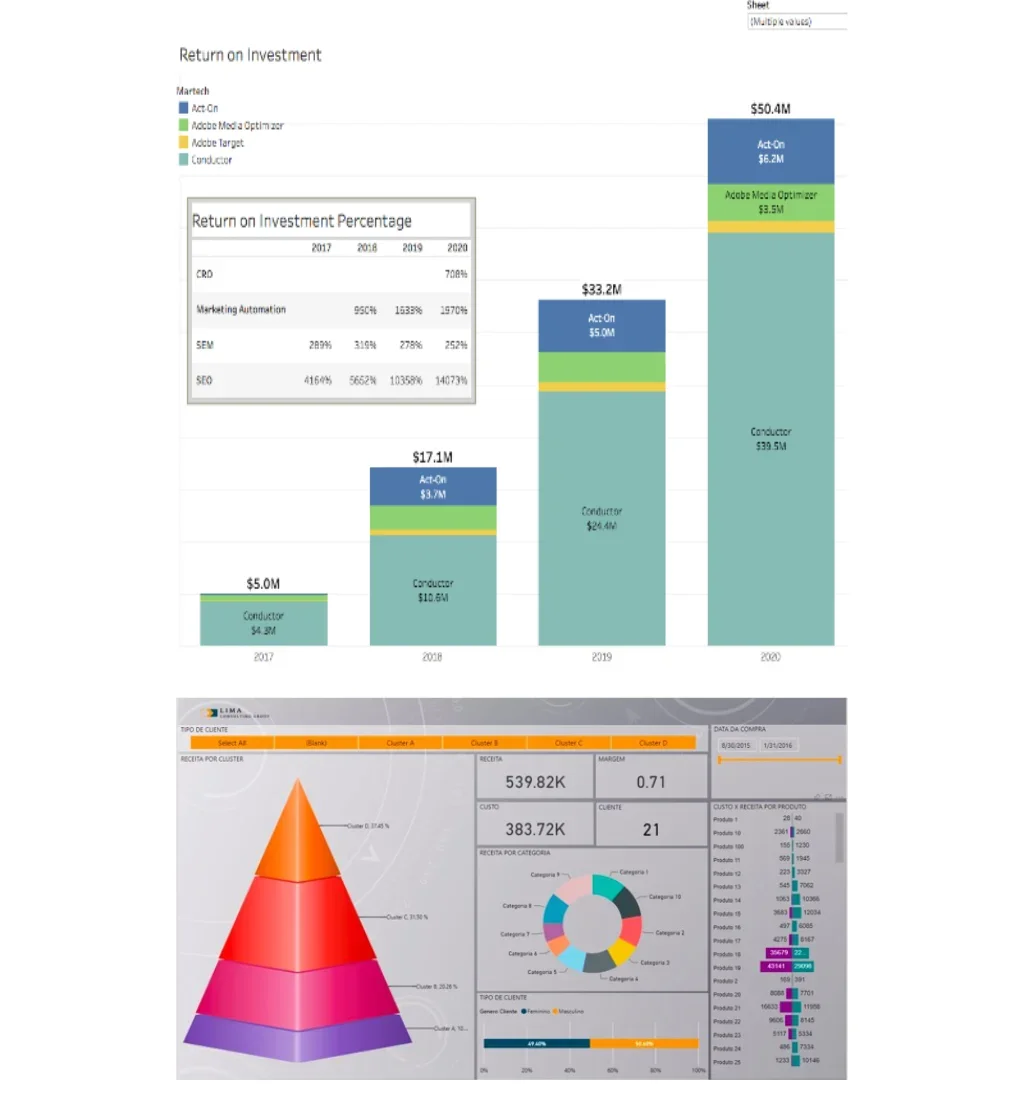

Return on Investment: ROI is typically calculated by comparing the costs of the financial transformation initiative, including the cost of implementing new systems and processes, to the financial benefits realized from the initiative. These benefits may include cost savings, increased efficiency, improved accuracy, and increased revenue.

For example, a financial transformation initiative that reduces the time and effort required to complete financial reporting tasks may result in cost savings by reducing the need for manual labor or outsourcing. Similarly, an initiative that automates financial processes may improve efficiency, reduce errors, and improve accuracy, resulting in cost savings and increased revenue.

Comprehensive Roadmap: Use a Financial Transformation methodology to (1) understand how your organization uses data and assess your data readiness, (2) assess your agility posture and clearly define how your organization will be agile to insights, innovations, technology enhancements and changing market dynamics and (3) sequence the order of what digital tools your organization will adopt. Here at Lima Consulting Group, we have developed a proprietary model for these three deliverables that we call the Financial Transformation Maturity Model.

The LCG Financial Transformation Methodology

Discovery:

This is the initial stage of a financial transformation, where the focus is on gaining an understanding of the organization's current state, its business processes, resources, capabilities, and constraints. It involves identifying the areas that need improvement and determining the goals that the organization wants to achieve.

Vision Formulation:

Once the organization has a clear understanding of its current state, the next step is to formulate a vision for the future. This involves defining the desired future state, identifying the business objectives that will help achieve this state, and establishing the criteria for success. It is in this stage where LCG will help you assess various business models and conduct some scenario planning and competitive intelligence.

Future state business objectives:

During this stage, the organization sets specific and measurable business objectives that it wants to achieve in the future. These objectives are typically aligned with the organization's mission and vision, and they should be achievable, realistic, and relevant.

Gap Analysis:

In this stage, the organization conducts a gap analysis to identify the gaps between its current state and its desired future state. This involves evaluating the organization's strengths and weaknesses, analyzing the external factors that affect the organization, and identifying the resources that are needed to achieve the desired state.

Recommendations and resource prioritization:

Once the gaps have been identified, the organization needs to develop a plan to bridge these gaps. This involves making recommendations for improvement, prioritizing the resources that are needed, and developing an action plan for achieving the desired future state. Roadmaps for the People, the Process and the Platforms gain alignment through a cohesive set of milestones and planning documentation.

Decisions and Approvals:

During this stage, the organization makes decisions about which recommendations to implement and approves the necessary resources to make the recommended improvements.

Execution:

The execution stage involves implementing the recommendations and action plan developed in the previous stages. This involves assigning responsibilities, monitoring progress, and making adjustments as needed.

Measure and Optimize:

Finally, the organization needs to measure its progress towards achieving its objectives, and optimize its processes to ensure that it continues towards its desired future state. This stage involves monitoring performance, evaluating the effectiveness of the improvements made, and making adjustments as necessary.

The Financial Transformation Cheat Sheet

Leaders can print this cheat sheet (the last page of the downloadable e-book) and keep it as a ready reference for how to lead their Financial Transformation.